SAN FRANCISCO—Analog Devices Inc. (ADI) will acquire rival Linear Technology Corp. in a cash and stock deal worth about $14.8 billion, the companies said Tuesday (July 26).

The deal, which remains subject to stockholder approval, would bring together two analog semiconductor powerhouses and would be the latest in a string of blockbuster semiconductor deals over the past few years.

Under the terms of the deal, ADI will pay $46 and 0.23 shares of ADI for each share of Linear Technology common stock, the companies said. The transaction values Linear at $60 per share, a premium of about 24% over its closing price of $48.47 Monday.

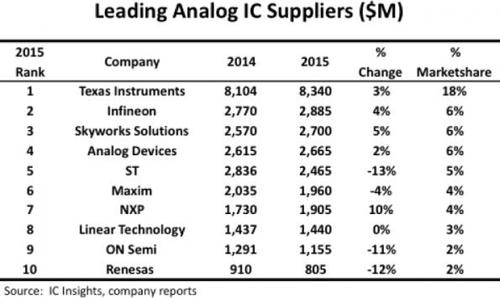

ADI ranked fourth in analog chip sales in 2015,, which Linear clung to the No. 8 position, according to market research firm IC Insights. Combined, the two firms held about 9% of the analog IC market in the first quarter, according to IC Insights.

“We believe this is the right deal at the right time in the analog industry,” Vincent Roche, ADI’s president and CEO, said in a conference call Tuesday.

While ADI and Linear Technology are both top 10 analog chip vendors, the two firms have complementary product portfolios, according to Steve Ohr, a longtime analog semiconductor analyst and journalist.

Most of ADI’s $2.67 billion in 2015 revenue came from data converters, Ohr said, with only about $150 million to $200 million from power management ICs. Linear is strong in power management chips, Ohr added.

“Power management is a place where Analog Devices is lacking, and Linear is very strong in power management,” said Ohr, who currently writes for EE Times. “It [the deal] actually build's Analog Devices' product offerings very well.”

The semiconductor industry has been in the midst of an unprecedented wave of consolidation for more than two years. In 2015 alone, the value of semiconductor industry merger and acquisition deals exceeded $100 billion. Blockbuster deals consummated during this period have included Avago Technologies Ltd.’s $37 billion acquisition of Broadcom Corp., Intel Corp.’s $16.7 billion acquisition of Altera Corp. and NXP Semiconductors NV’s $11.8 billion acquisition of Freescale Semiconductor Inc., among others.

----Form EE Times